Invest inReal Estate Investment Trust ETFss (REIT), Bonds, Stocksand much more with the help of AI.

AI B2B SOLUTION

Financial AI API at your command

Meet the API that combines real-time financial data and alternative data with deep domain expertise to deliver accurate, personalized, and actionable insights seamlessly integrated into your products.

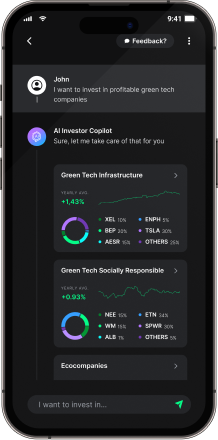

You

I want to invest in companies leading the generative AI space

AI Investment Advisor

Sure, I can show you leading companies in the AI space

Customized investments

I created a new investment portfolio

Generative AI Revolution

This strategy invests in companies that have embraced generative AI, positioning them for potentially increased revenue in the future. Companies with stable dividends and no military involvement historically provide steady returns, but remember that historical performance does not guarantee future results. High volatility and inflation risks can be managed by a diversified portfolio.

Stocks and ETFs selection

For this portfolio I allocated the following stocks and ETFs

Daily, weekly or monthly rebalancing

I will monitor analyst ratings, news articles, earnings, regulatory and stock prices changes to keep your portfolio up to date

FREQUENCY

DAILY

WEEKLY

MONTHLY

OFF

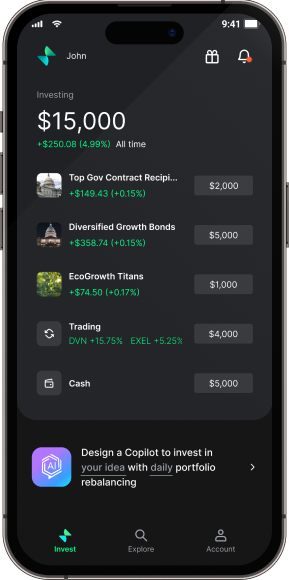

EcoGrowth Titans portfolio was updated 1 day ago

AAPL

4%

5%

Apple has been downgraded by UBS analyst and faces a trademark battle in China. However, it still has strong fundamentals and growth potential, so we are reducing the allocation slightly

NVDA

4%

5%

Amazon Web Services has showcased new products and services, and the company is expected to benefit from the AI boom. However, given the current market volatillity, we are slightly reducing the allocation

Performance simulation

I also generated a backtesting perfomance simulation. And remember, past performance does not guarantee future results

Generative AI Revolution

This strategy invests in companies that have embraced generative AI, positioning them for potentially increased revenue in the future. Companies with stable dividends and no military involvement historically provide steady returns, but remember that historical performance does not guarantee future results. High volatility and inflation risks can be managed by a diversified portfolio.

AI Investment Advisor

Would you like to invest in this portfolio?

Download the app

I'd like to know more

POPULAR PORTFOLIOS READY TO INVEST

U.S. Congress Buys

Republicans win the election

U.S. House Buys

Crypto exposure

Generative AI Revolution

Top Gov Contract Recipients

Nancy Pelosi Tracker

Taylor Swift Strategy

Bond Ladder 8.11% YTM

Democrats win the election

And more

U.S. Congress Buys

U.S. Congress Buys Republicans win the election

Republicans win the election U.S. House Buys

U.S. House Buys Crypto exposure

Crypto exposure Generative AI Revolution

Generative AI Revolution Top Gov Contract Recipients

Top Gov Contract Recipients Nancy Pelosi Tracker

Nancy Pelosi Tracker Taylor Swift Strategy

Taylor Swift Strategy Bond Ladder 8.11% YTM

Bond Ladder 8.11% YTM Democrats win the election

Democrats win the election- Design your own AI Managed Portfolio (AMP)Describe what you want to invest in and let our AI create a customized portfolio that is designed to meet your goalsCustomized or not, our AI powered system manages the portfolio allocations using real-time news and market changes

Describe your investment ideaWhat kind of investment you want to create?I’d like to invest in precious metals like gold and silverMessage

Describe your investment ideaWhat kind of investment you want to create?I’d like to invest in precious metals like gold and silverMessage

Examples are for illustrative purposes only and should not be considered individualized recommendations or personalized investment advice. The investment strategies mentioned may not be suitable for everyone.

Business Insider and Benzinga received compensation for publishing articles about Streetbeat on their respective websites. Streetbeat, LLC and the aforementioned companies are independent entities and have no formal relationship beyond this specific arrangement.

HAVE ANY QUESTIONS?

Frequently asked questions

General

What is Streetbeat?

All about Portfolios

What are the available Portfolios?

How to allocate funds in the Streetbeat Portfolios?

How can I create a personalized Portfolio?

How to switch from one Portfolio to another?

I just added funds to a Portfolio, but haven't seen any trades. What to do?

Can I do manual trading?

Sign up and getting started

What brokerage accounts can I connect to Streetbeat?

How to link my brokerage account with Streetbeat?

How to create an account if I don’t have a brokerage account yet?

Are the brokerage integrations safe?

Subscriptions and payments

What are the fees?

I need more help

How do I contact customer support?